WHAT IS YOUR LEGACY?

- Legacy: Noun: /’leg.ǝ.si/

- Law. a gift of property, especially personal property, as money, by will; a bequest.

- Anything handed down from the past, as from an ancestor or predecessor

– Oxford Dictionary

3. The mark you leave on the world, woven in the lives of others, during your lifetime and beyond.

– Jeremy Mills

Because most people believe that wealth is the major enabler of their

Legacy, we take the time to

UNDERSTAND how you wish to grow, preserve and protect your wealth.

Understand | Create | Sustain

ABOUT US

Over 25 years of managing the affairs of wealth creators and their families.

Our every interaction is shaped by our values and intent to do right by our clients today and for the future, delivered through enduring relationships

Understanding your unique situation is fundamental when creating a charter to navigate the complexed world of taxation and inheritance sustaining, down through the generations.

Understand | Create | Sustain

OUR TEAM

Our team of lawyers, consultants, relationship managers and associates is headed up by Jeremy Mills, the senior partner and founder.

Jeremy is a practising solicitor and qualified as a Notary Public having attained the Diploma in Notarial Practice from Cambridge University. Notaries are generally sought in the United Kingdom for the authentication of documents for use abroad.

He also maintains a number of local and national charitable trusteeships and is very active in the “Third Space”.

At Mills Keep, each member of the team selected to work on every client matter is hand picked to ensure the right balance of advice and communication is delivered.

CLIENT FACING STAFF

All employees at Mills Keep play an important role in the day to day running of the company. Our key client facing employees are as follows. Additional employees who may work on your case will be introduced to you where necessary.

JEREMY MILLS: DIRECTOR

Jeremy, founder and director of Mills Keep is a solicitor and Notary Public, a member of the Society of Trust & Estate Practitioners and Charity Law Association. Jeremy has over 25 years’ experience managing the affairs of wealth creators and their families with a particular focus on navigating taxation and sustaining inheritance down the generations.

JILL RICHMOND: TRAINEE SOLICITOR & PA

Jill is an experienced Paralegal and is Jeremy’s Personal Assistant with additional skills in Marketing and Business Development. Jill is currently undertaking Solicitor training through the SRA’s Solicitors Qualifying Exam.

CAROL HINVES: ACCOUNTS ASSISTANT

Carol is a fully qualified bookkeeper and as well as ensuring Mills Keep stays on a financial even keel, assists in managing clients’ accounts and investments.

GAVIN MAITLAND-SMITH: SOLICITOR ADVOCATE

Gavin is a Solicitor. Having passed his Bar exams in 2002, he spent the next 20 years working in commercial lending and financing and so has a wealth of experience in assessing and managing businesses.

LEWIS WOLSTENHULME: PARALEGAL

Lewis assists generally in preparing client documents and has a particular role in managing the administration of estates. He also assists Jeremy (in his capacity as a Notary Public), in arranging meetings and preparing documents for Notarial certification.

It is our priority to CREATE a wealth plan which delivers your objectives

Understand | Create | Sustain

OUR CLIENTS

Mills Keep help successful business owners and busy professionals protect their income and wealth. We provide the support required to design their Wealth Plan needed to ensure their life aspirations are met, so they can devote their energy into growing their business or furthering their career

Because we understand that the opportunities and security your wealth can bring for your family and future generations is important to you, we offer a perspective down the generations. All the while being respectful of your choices of how you wish to impact your family, friends and wider community, during your lifetime and beyond. In other words, “Your Legacy”

It can be a daunting, managing a large and diverse portfolio in the context of the complex and changing nature of modern family relationships.

Mills Keep offers guidance on how to direct the family wealth so that it not only perpetuates down the generations, but grows. We help to create structures that engenders harmony, thus avoiding the divisiveness that unplanned wealth can bring.

MILLS KEEP SERVICES AND PRICING GUIDELINES

Our ethos is to meet and obtain a full and complete picture before providing advice in any one area. Within that often there are a number of areas which may need attention and/or which are important to a client and we outline below the topics that often arise. We endeavour to be as clear and transparent about costs as possible both at the outset and, where appropriate, throughout our retainer.

CHARITIES & NOT FOR PROFIT

We advise on the creation and registration of new charities with costs typically between £1,500 and £5,000 + VAT* depending on the structure required and the charity’s objects.

We also advise charity trustees on their duties and responsibilities and governance issues and the executive board on issues arising during the administration of charities. Such advice is quite specific to the prevailing circumstances and charges will be agreed in advance and from time to time as appropriate.

COMMERCIAL & CORPORATE ADVICE

As part of our advice service, the provision of commercial advice and the preparation of commercial documents is often required. These can range from the formation of Limited Liability Partnerships and companies, the preparation shareholders’ agreements and members’ agreements loan documents and specific commercial contracts. Each document will be bespoke to the individual requirements and generally a fixed fee will be offered depending on those requirements. Costs can typically be between £1,500 to £5,000 + VAT* depending on the type and number of documents required.

ESTATE ADMINISTRATION / PROBATE

At Mills Keep we do not believe that administering the estate of someone who has died is merely a paperwork process. There are often many tax points to consider and sometimes the amendment to a Will by way of a Deed of Variation.

We are happy to work on a fixed fee or on a time basis. As with most advisers in this area, fixed fees can be set at anything between 1% to 3% of the gross value of the estate (+ VAT*, currently at 20%). On occasion we may be prepared to agree a specific fixed fee. We would be happy to discuss the options with you.

We can also assist in obtaining grants of representation abroad to release assets in those jurisdictions and in resealing grants of representation in the UK and abroad. Depending upon the jurisdiction and the extent of our involvement required we should be able to offer a fixed fee which we can agree with you when the scope of the work has been agreed.

It is always difficult to predict how long it will take to complete the administration of an estate and the following process but to provide a rough guideline:

- Obtaining estate administration information i.e deceased personal information, death certificate, original will, estate assets and liabilities info, registering death with providers and obtaining date of death values.

- Drafting IHT forms to register estate value with HMRC – can usually take 1 -2 months to get to this point

- Wait for HMRC to issue IHT421 to probate registry.

- Submit original will and legal statement to probate registry for grant of probate.

- Once grant of probate obtained all estate assets encashed or transferred to beneficiary in will depending on wording of will.

In our experience even the simplest estates will usually take around six months. Most estates will take at least twelve months, possibly longer, to be administered.

If there are difficulties, for example, assets which cannot be realised quickly, or where the valuation is uncertain and figures have to be agreed with HMRC, the administration can take much longer than twelve months.

While we endeavour to progress the administration of the estate as quickly as we can, we are dependent on responses from HMRC, from those valuing assets, and from those providing us with information which we need.

We will always keep you updated and explain the steps that need to be taken.

We will bill periodically in accordance with the agreement reached with you and our invoices are due for payment within 14 days of issue. Our fees are exclusive of VAT*, which will be added at standard rate currently 20%. Disbursements incurred on your behalf and expenses incurred in the course of carrying out our work for you will be added to our invoices where appropriate and sometimes we may ask to have these costs covered in advance. Please see below for information on disbursements:

Probate registry fee: £273

Fee for office copies of the grant: £1.50 for each copy (the number required will depend on the number/range of assets)

Search fees: £2.00 per beneficiary plus VAT*

Registry copies: Register view of property (per title): £3 plus VAT*

Registry copies: Plan view of property (per title): £3 plus VAT*

Cost of statutory adverts: approximately £300, plus VAT* (not always essential but usually advisable for the protection of the executors).

Probate Court Costs – £273 plus £1.50 for every additional copy of the Grant

Notice inviting creditors to come forward (estimate only and not always necessary) – from £100

Bankruptcy Searches of Executors and Beneficiaries – £2 plus VAT*

Asset searches – costs vary but average is £185 plus VAT*

Updating a title via an AS1: fees as per: https://www.gov.uk/guidance/hm-land-registry-registration-services-fees

* VAT is currently charged at 20%

ESTATE PLANNING AND TAX ADVICE

We need to have a knowledge and understanding of your affairs, in order to give you the best advice for your circumstances and therefore provide you with an accurate guide to the cost. Accordingly, we are normally prepared to have an initial preliminary meeting at our expense to ascertain how we can help you.

Following a meeting and any further information gathering required, we will make a proposal which may include the preparation of one or more documents and corresponding advice. However, wherever possible we will endeavour to agree with you a fixed fee for the agreed advice and documentation required.

OFFSHORE

We regularly advise on offshore issues including the facilitation of the formation and management of offshore trusts and companies and the distribution of funds to UK resident and domiciled beneficiaries. We also advise on the UK implications of residence and domicile and issues arising from holding assets in offshore jurisdictions.

All of this advice is very specific to circumstances and charges will be agreed with you in advance before work is undertaken.

POWERS OF ATTORNEY

Any type of specific or general Power of Attorney can be prepared in accordance with your instructions.

Many people are interested in executing Lasting Powers of Attorney (LPAs). There are 2 forms of LPA: Property & Financial Affairs (PFA) LPA; and Health & Welfare (H&W) LPA.

We have sympathy with the point of view in circumstances where a person does not take legal advice, but either prepares the document himself/herself or relies on a family member or friend or carer to do it for him/her. If the document is prepared by a lawyer, the person has confidence that it is being prepared properly and that there are built in safeguards to its release and use if and when required.

Also, when a lawyer prepares one of these documents, the question of restrictions, conditions or additional powers arises. No wording for these will be found in the online forms. Invariably, we will include specific powers and authorities to facilitate the easier administration of a person’s affairs if the document is ever required to be used.

We offer the preparation and completion and registration of Lasting Powers of Attorney for fixed fees as follows

For an individual £600 + VAT* for 1 and £750 + VAT* for 2.

For a couple £750 + VAT* for 1 each and £1,250 + VAT* for 2 each

In addition to these fees, for each LPA registered the Office of the Public Guardian makes a charge of £82 a document.

TRUST ADMINISTRATION & fiduciary services

Trusts can provide an effective way of helping to manage and protect a family’s finances. However, to achieve most value from them they need to be actively managed and reviewed regularly.

We offer an advisory service to trustees and a full trust administration service, which often involves accepting a trusteeship, registering the trust with the appropriate revenue authorities, maintaining trust records, and arranging (and minuting) regular trustees’ meetings.

If one-off trust advice is required, wherever possible we will agree a fixed fee with you depending on the extent of the advice required.

If a full administration is required, then costs will depend on whether it is a new or existing trust and if existing, how well records have been kept in the past. Unless we drafted the trust for you, we may look to make an initial due diligence and compliance fee of between £500 and £1,500 + VAT*. Ongoing administration fees will depend on the size and complexity of the trust and typically range for £750 to £2,500 + VAT* a year. The cost of any legal document or additional advice outside the agreed provision of administration services will be agreed with you at the time and as required.

WILLS

We do not provide quotes for Wills before a meeting. We regard the preparation of wills as very much part of a personal review and a consideration of tax, financial and practical issues for the testator and the testator’s family. Very often this advice might give rise to the recommendation that a Will is prepared.

Following a personal review, any Will proposal we put forward will relate to the information we receive and the precise nature of a client’s affairs. Wills are drafted as part of an advice service. In that context fees can range widely and can fall anywhere between £750 and £5,000 + VAT*. However, wherever possible we offer a fixed fee for the agreed advice and documentation required.

* VAT is currently charged at 20%

TIMESCALES

We will attend to your instructions as diligently and efficiently as possible and agree any sensible and realistic timescale for the completion of the work required with you wherever possible.

The completion of the advice required is likely to be dependent on you complying with a request for information we make and/or to the approval of draft documentation. Any delay in responding to us will inevitably result in delay in completing the work. We cannot be responsible for delay caused by you.

Similarly, if we are dependent on receiving information from a third party who may be instructed by you before or after our appointment or by us on your behalf and that third party delays in responding to us, any such delay in responding to us will inevitably result in delay in completing the work. We cannot be responsible for any delay caused by a third party.

It’s more than tax advice and will writing. It’s having a Wealth Plan to guide and SUSTAIN your Legacy down through the generations.

Understand | Create | Sustain

ARTICLES & INSIGHTS

NEWSLETTER

BLOG

CONTACT US

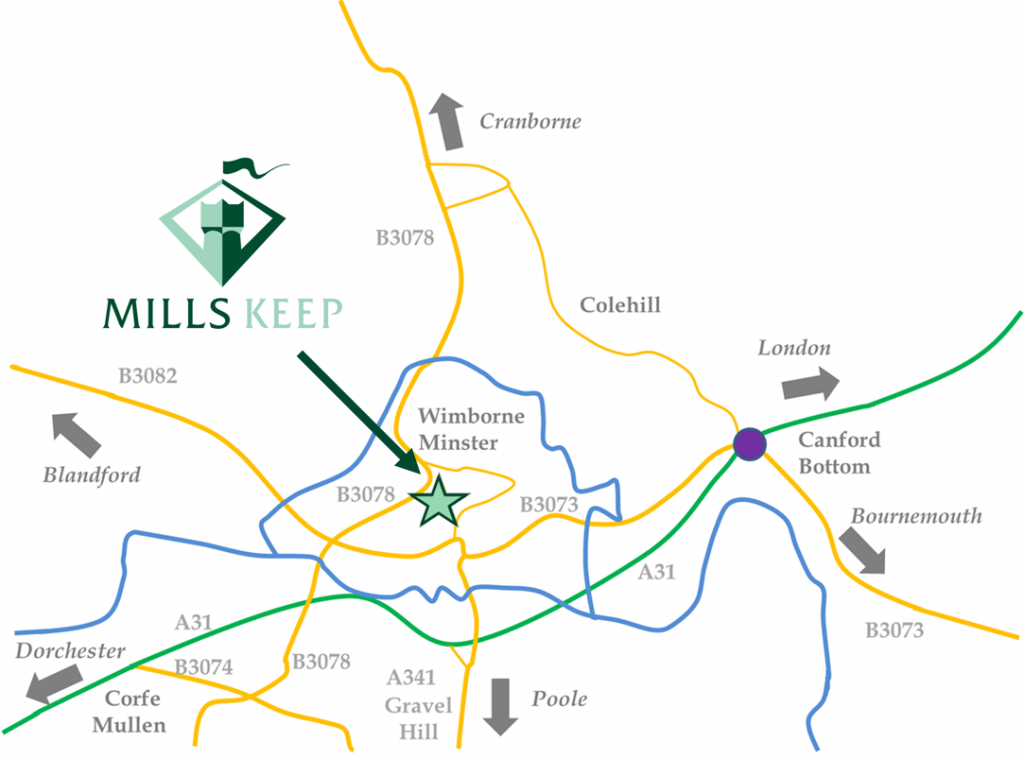

HOW TO FIND US

From all directions:

Follow signs to the town centre.

The closest parking can be found in King Street

Car Park (BH21 1EA). To reach this follow

the one way system through the town,

keeping the Minster on your right, and

turn right into the car park opposite

Wimborne Model Town.

From the car park, walk towards the

Minster and follow the left path in front of the

Church.

Walk through the open gates and straight

past the Salvation Army Church on your left.

Directly opposite is Dorset House.

Mills Keep Limited

Dorset House, 5 Church Street

Wimborne, Dorset, BH21 1JH

Tel: +44 (0)1202 886255